Markets turned down in the first 6 months of this year, but they’ve trended up in July. Even with Friday’s pullback, the regular gains are reliable, nearly 5% on the S&P 500 and 7.5% on the NASDAQ, marking a turnaround from the prolonged drop we saw previously.

The concern buyers have is, is this turnaround authentic, or just a temporary achieve in a more substantial bearish pattern. That remains to be found, but either way, even if the industry reverts to its bearish trend, there will be prospects for traders – locating them will be the crucial to results.

There’s no way to genuinely forecast how a stock will accomplish. The old adage says, ‘Past accomplishment is no ensure of upcoming gains.’ But that will work both equally strategies, and new losses never always predict more declines. So most likely we should convert to the professionals, and come across out what some of Wall Street’s inventory professionals are choosing as winners correct now.

The analysts at banking huge Goldman Sachs have been looking for stocks with the opportunity for warm gains in the coming months – on the purchase of 40% or extra. The GS specialists have taken an upbeat look on particular person stocks, despite this market’s complete-calendar year downward craze. Now let’s get a feel for their optimism by working with the TipRanks platform to pull up the most current facts on two of their picks. Here they are, together with the analysts’ commentary.

Allogene Therapeutics (ALLO)

The to start with stock we’ll look at, Allogene Therapeutics, is a biopharmaceutical firm pursuing investigate in cancer immunotherapies, utilizing allogenic chimeric antigen receptor T-cells, or AlloCAR T, to establish new brokers for illness procedure. These are function-designed precision medicines that get the job done with the patient’s possess immune process to assault cancers. The firm is at the clinical phase, with various drug candidates going through human clinical trials.

In latest information on the clinical entrance, Allogene’s most state-of-the-art candidate, ALLO-501A, acquired regenerative medication state-of-the-art remedy (RMAT) designation from the Food and drug administration, giving the application an expedited position. ALLO-501A’s new designation adopted on a optimistic information release from the ALPHA2 trial, which is screening the drug on sufferers with relapsed or refractory Huge B mobile Lymphoma (LBCL). The knowledge showed that AlloCAR T therapies are safe and effective, and create strong affected person responses. The corporation designs to initiate a Section 2 pivotal demo this year.

In a different the latest clinical software update, Allogene announced that its new drug candidate ALLO-316 has started out the Section 1 TRAVERSE trial, to consider security, tolerability, anti-tumor efficacy, pharmacokinetics, and pharmacodynamics. This drug candidate is the company’s initial to focus on strong tumors, and the TRAVERSE demo has enrolled individuals with superior or metastatic clear mobile renal mobile carcinoma (RCC). The demo is now learning its next cohort, and further more enrollment is ongoing. ALLO-316 was granted the FDA’s Rapid Track designation in March of this year.

Last but not least, the enterprise is studying ALLO-715 in the treatment of various myeloma. This drug candidate is the issue of the Universal demo. ALLO-715 has promise in focusing on BCMA (B cell maturation antigen) for client procedure.

Allogene’s considerable medical software is pricey, and the enterprise expended some $60 million on R&D in 1Q22. This was paired with an extra $19.9 million in G&A paying. When substantial, this expending is supported by the company’s cash and liquid asset holdings, which totaled $733.1 million at the conclude of the quarter, suggesting a income runway for operations extending as a result of the subsequent 9 quarters.

In her coverage for Goldman, 5-star analyst Salveen Richter factors out the vital forthcoming catalysts below, creating, “…we anticipate a period of time of execution on direct allogeneic Auto T plans ALLO-501A (anti-CD-19) … exactly where Food and drug administration alignment on and initiation of the pivotal trials in mid-22 pave a route towards approval, and ALLO-715 (anti-BCMA) … where by clarity on the ahead route is anticipated by YE22 for each longer-time period follow-up monotherapy data… Individually, we note initially knowledge from the Ph1 ALLO-316 TRAVERSE review in renal mobile carcinoma in 2023 could unlock the stable tumor vertical.”

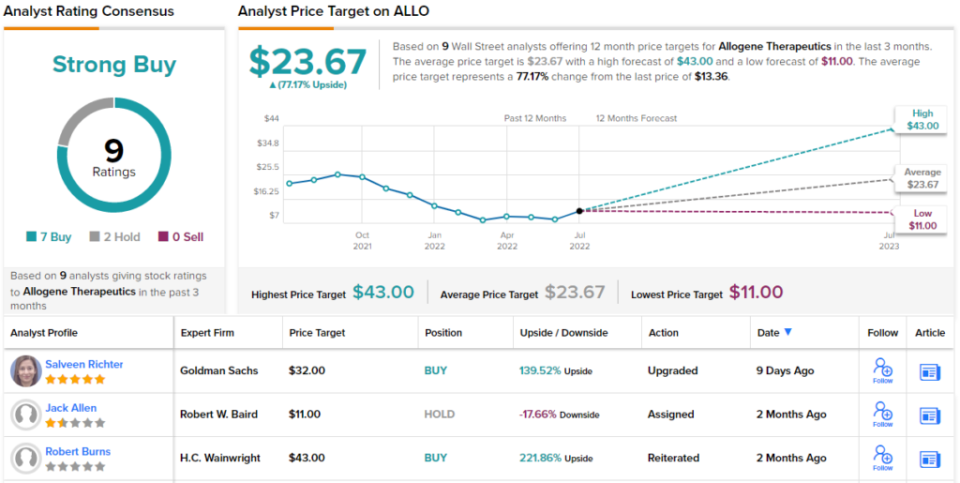

Richter doesn’t prevent with constructive responses. She updates her stance on ALLO from Neutral to Get and has a $32 selling price concentrate on that indicates a 139% upside for the up coming 12 months. (To observe Richter’s track history, click on here.)

This immunotherapy researcher has picked up 9 recent analyst testimonials, and these split down to 7 Purchases from just 2 Retains for a Solid Buy consensus rating. The shares have an regular value target of $23.67 and a current investing selling price of $13.36, indicating a 77% upside probable on the 1-12 months time frame. (See Allogene inventory forecast on TipRanks)

Prometheus Biosciences (RXDX)

The next Goldman decide on we’re on the lookout at is a further biopharma in the precision drugs market. Prometheus is functioning on new remedies for immune-relevant gastrointestinal circumstances, with a emphasis on inflammatory bowel conditions (IBD). Most of Prometheus’ method is in early, preclinical levels, but the corporation does have a person drug applicant, PRA023, now undergoing a few human medical trials to treat Ulcerative Colitis, Crohn’s Illness, and Systemic Sclerosis-related Interstitial Lung Illness (SSc-ILD). The organization makes use of a biomarker-specific therapeutic technique, based mostly on a patient’s biomarker profile. This affected individual-centric method delivers the promise of reworked affected person results.

Prometheus has recently described numerous updates to its medical demo programs of PRA023. Very first, the firm has initiated a 3rd Phase 2 research of the drug candidate, focusing on SSc-ILD. The analyze was initiated in March of this yr, and major line benefits are anticipated in 1H24.

Upcoming was the announcement that the Food and drug administration had granted Speedy Track designation to PRA023 on the SSc-ILD keep track of.

Finally, the enterprise acquired a US patent for PRA023. The new patent handles “claims directed to methods of treating Crohn’s condition or ulcerative colitis by administering inhibitors of tumor necrosis component-like cytokine 1A (TL1A) to patients chosen by a outlined companion diagnostic examination.” Intellectual assets is a essential asset in biopharmacology, and this patent can help safeguard Prometheus’ investment in PRA023 until 2040.

Chris Shibutani, a further of Goldman’s 5-star biotech industry experts, writes of Prometheus, “We have a favorable perspective of RXDX’s to bring precision medicine to UC and CD, provided the markets are substantial and very well-produced, and the recent conventional of treatment therapies elicit modest prices of clinical remission. We believe that there is considerable price from PRA023 in IBD indications, and see upside prospective growing into SSc-ILD, as very well as the company’s ability to leverage their platform to build novel brokers and diagnostics to address extra affected person populations.”

With these upbeat feedback in intellect, it is no shock that Shibutani initiates his firm’s protection of RXDX with a Obtain score, though his $51 price tag goal suggests a one-calendar year upside potential of 47%. (To check out Shibutani’s keep track of file, click right here.)

It is obvious from the unanimous Robust Buy consensus score on this stock that Wall Street is in wide arrangement with the bullish Goldman check out all 7 of the modern analyst reviews here are beneficial. The inventory is currently investing for $34.65, and its $52 average selling price concentrate on indicates a 12-thirty day period achieve of 50% lies ahead for Prometheus. (See RXDX inventory forecast on TipRanks)

To uncover good tips for stocks trading at desirable valuations, stop by TipRanks’ Finest Shares to Obtain, a recently launched resource that unites all of TipRanks’ fairness insights.

Disclaimer: The views expressed in this post are only those of the featured analysts. The written content is supposed to be employed for informational functions only. It is very critical to do your very own investigation just before creating any investment decision.