The pursuing is an complimentary excerpt from our Marketplaces This Month dispatch from our premium newsletter called VC+. For a lot more like this, get a VC+ once-a-year membership for 25% off.

Analyzing the Resources of Five “Super Investors”

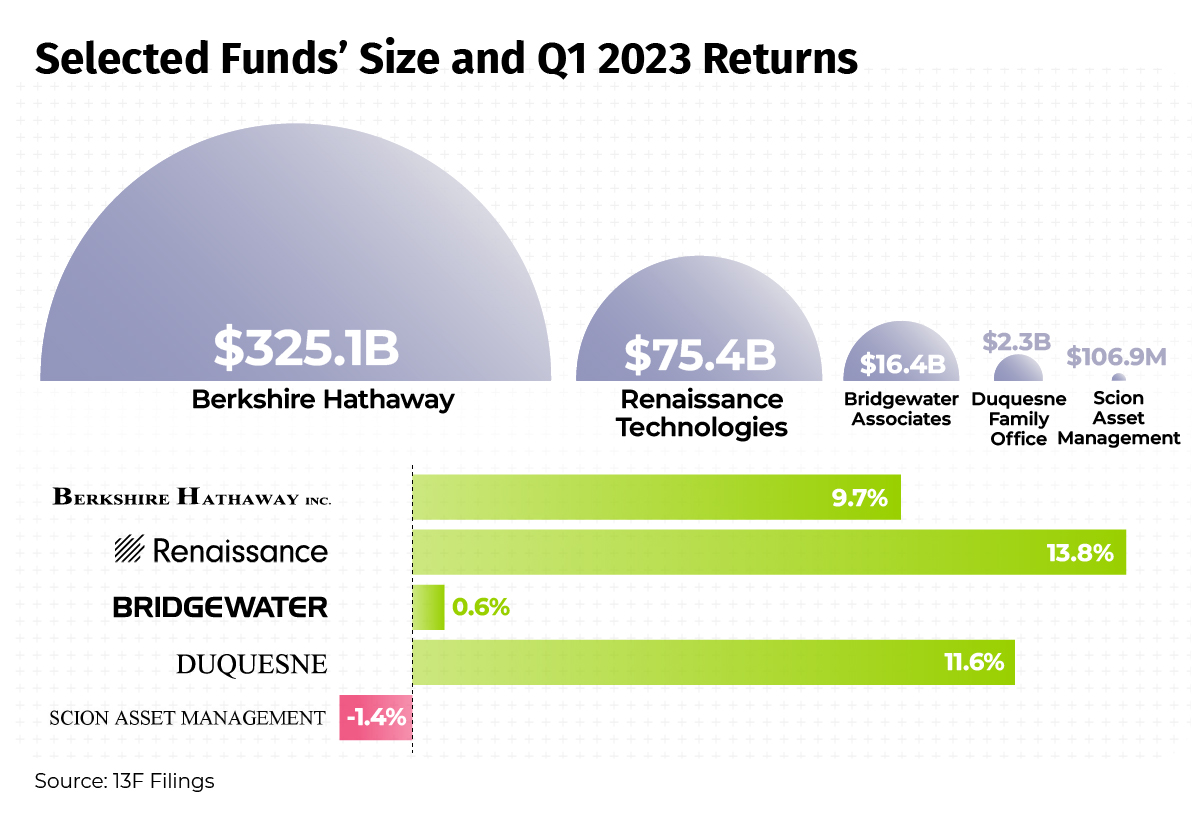

With the marketplace ordinarily taking a breather all through the summer time, it is a excellent prospect to analyze how prime cash positioned their portfolios at the conclude of Q1 2023.

We chosen five money of numerous measurements, each a single with a renowned investor at its helm that frequently has a exclusive outlook on the market place and system toward setting up out their portfolio.

The discrepancies in portfolio compositions underline the wide range of expense tactics, demonstrating how some of the top traders solution portfolio building.

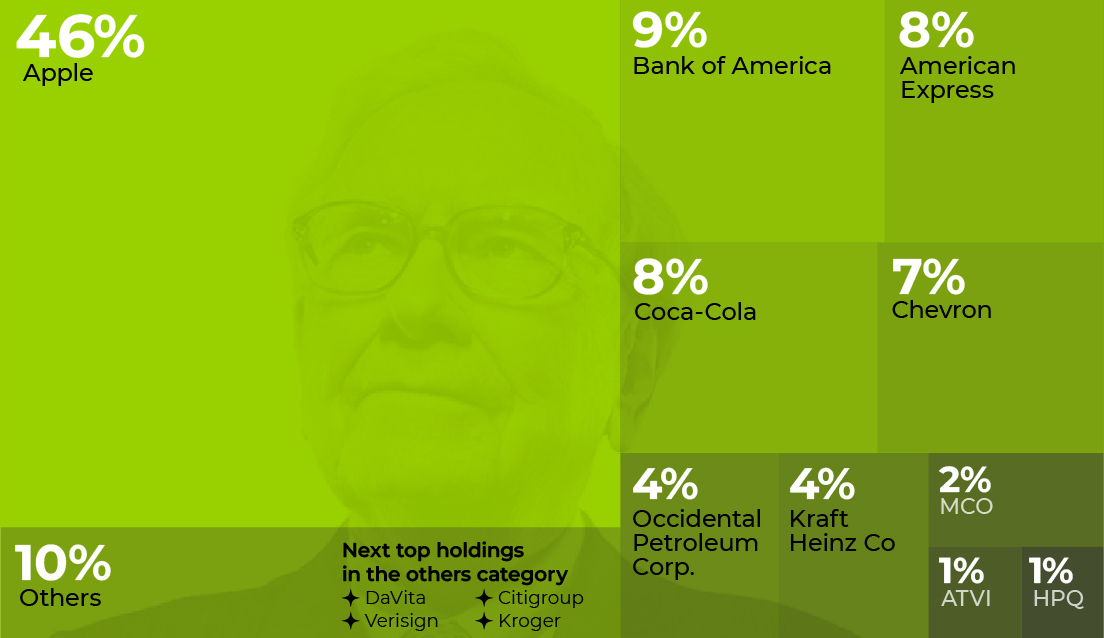

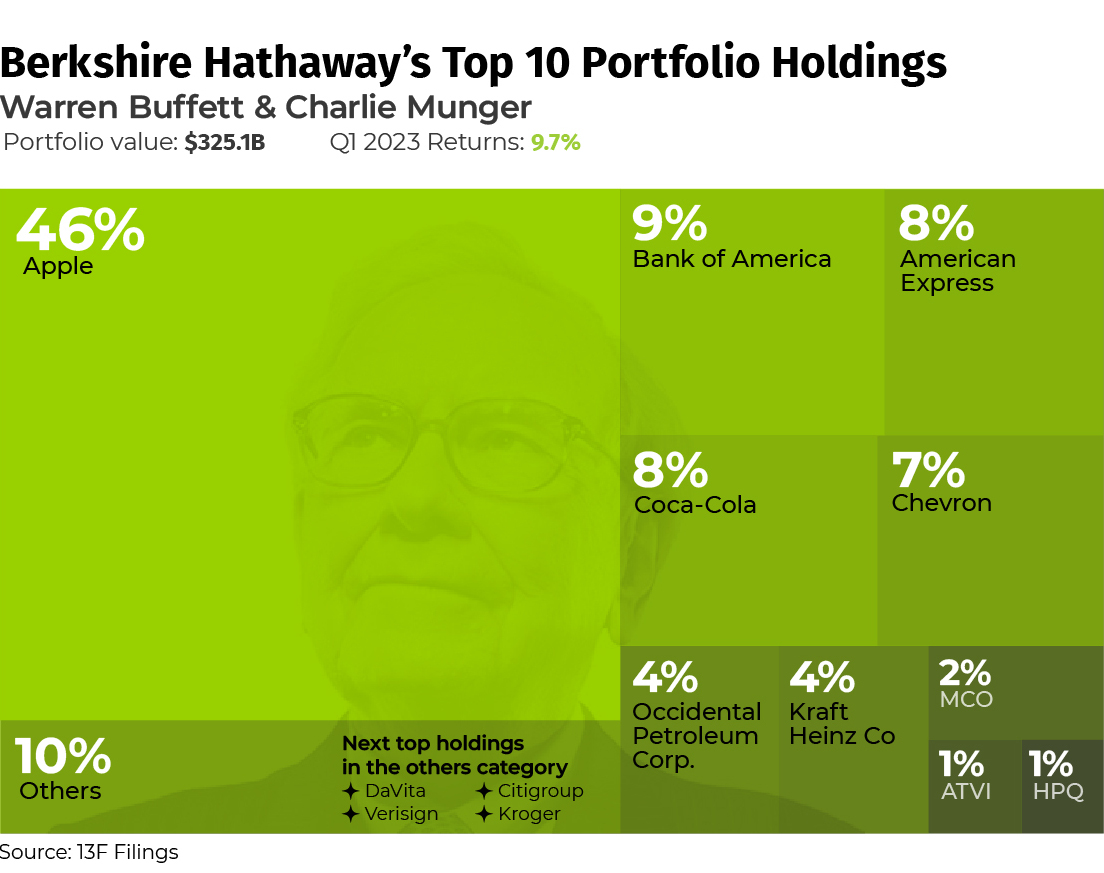

Berkshire Hathaway has a single of the world’s finest regarded and most productive portfolios, which has substantially outperformed the S&P 500 in excess of the lengthy expression.

Even though the S&P 500 has returned 195% due to the fact 2013, Warren Buffett and Charlie Munger’s fund grew by 260% over the same time time period.

Whilst Buffett is known for preaching diversification, pretty much fifty percent of Berkshire’s portfolio is all in the market’s most useful firm, Apple. The relaxation of the portfolio is relatively diversified with a mix of lender shares, purchaser staples like Coca-Cola and Kraft, together with oil and fuel firms.

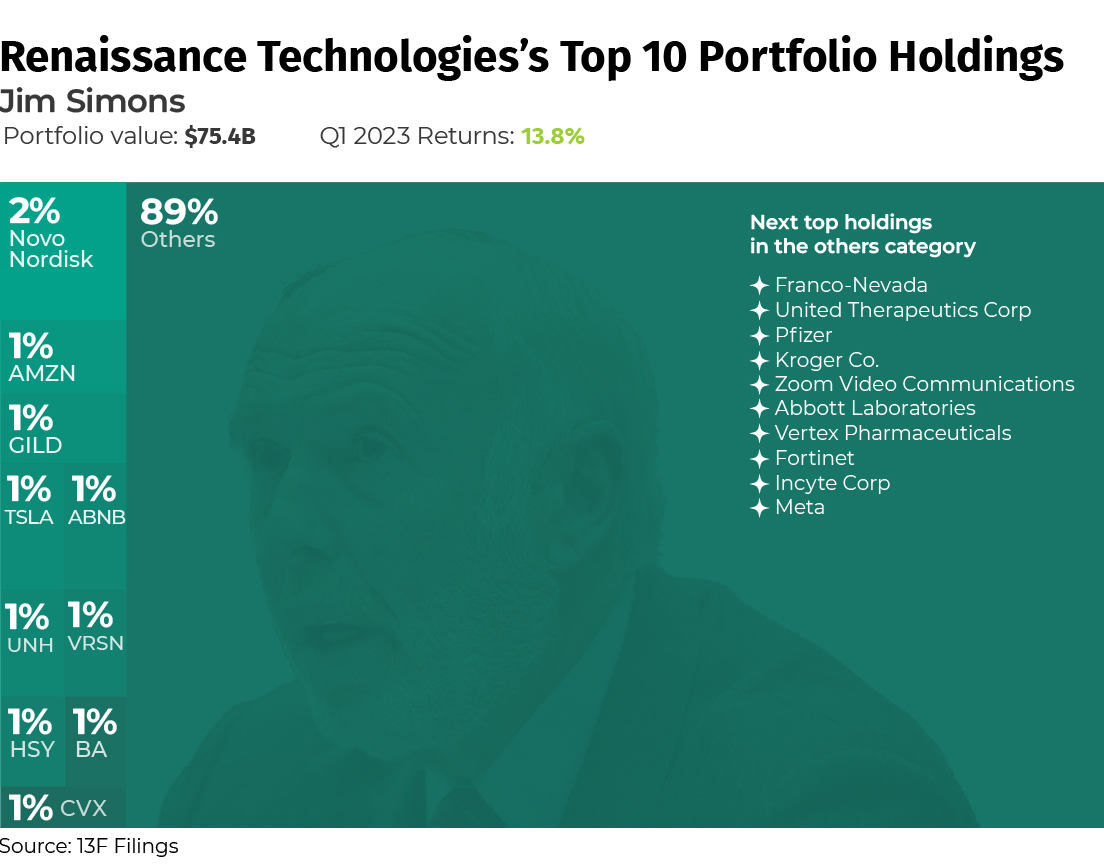

Jim Simons’ hedge fund, Renaissance Technologies, is very best regarded for its groundbreaking use of elaborate mathematical designs and algorithms which pioneered the observe of quantitative investing.

As a result, the hedge fund’s portfolio holdings showcase astounding diversification, with the fund’s major holding being a 2% allocation to pharmaceutical huge Novo Nordisk.

The portfolio is split throughout much more than 3,900 diverse positions, showcasing the fund’s technique of squeezing out returns from a various collection of investments via its algorithm-driven, statistical arbitrage tactic.

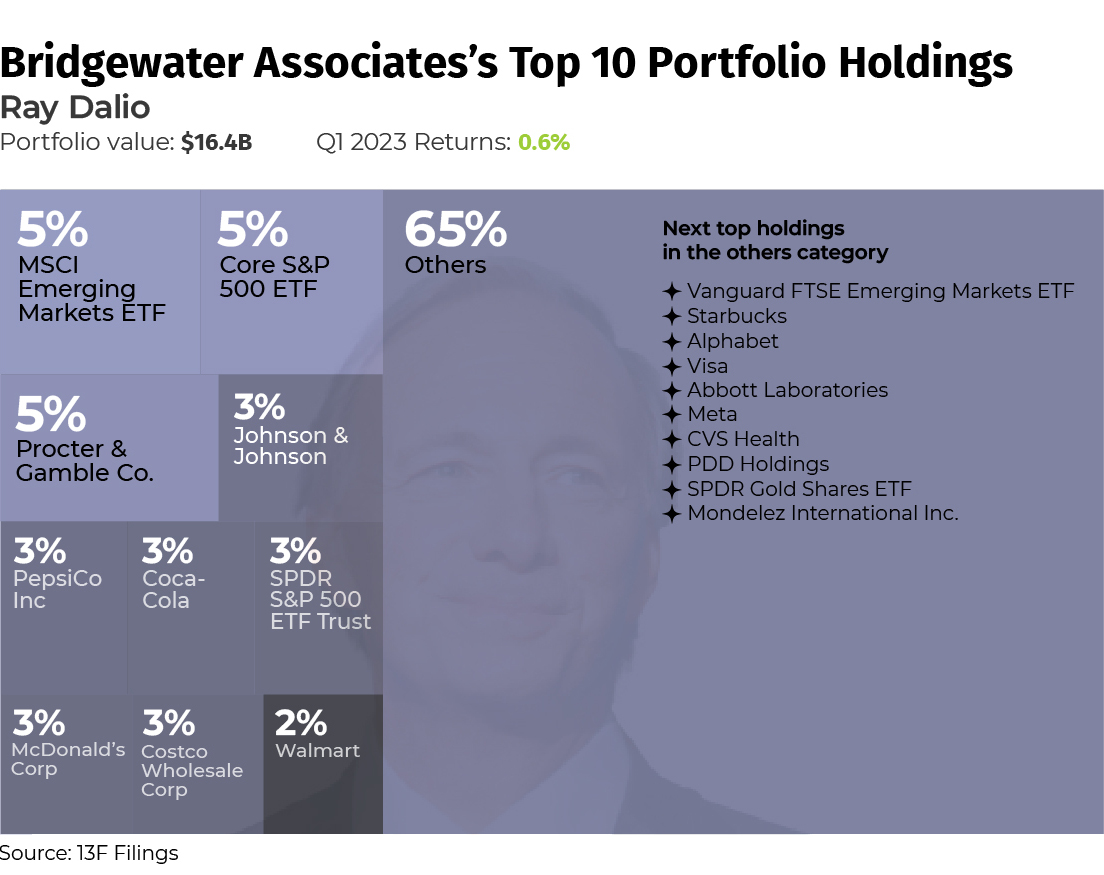

Ray Dalio’s Bridgewater Associates was one particular of the couple hedge money to predict and correctly navigate the 2008 money disaster, mainly thanks to its “all weather” system which appears to execute properly in all financial environments through diversification and a danger-parity solution to asset allocation.

As a outcome, you see lots of parallels and “counterweights” in the fund’s holdings. Its most significant keeping of MSCI’s Rising Markets ETF is balanced out by the Core S&P 500 ETF.

Bridgewater is also one particular of the few money which holds shares in a gold ETF. Though other funds we’ve appeared at have investments in gold royalty corporations or miners, which possible have potent harmony sheets and enterprises to guidance the financial investment, Dalio’s fund has favored to devote immediately in the important metallic.

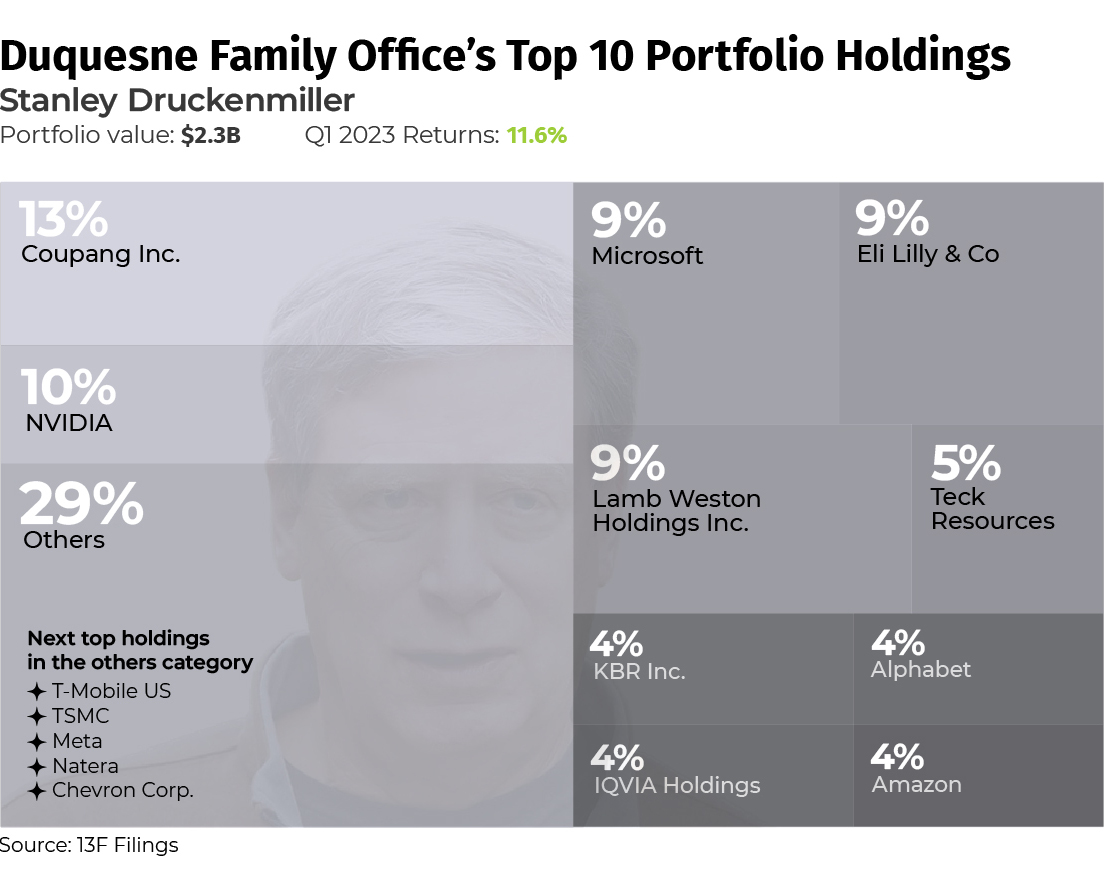

Stanley Druckenmiller is ideal identified as possessing been a important strategist for George Soros’s Quantum Fund, along with his have reliable file of returns with Duquesne which average 30% on a yearly basis.

Acknowledged for his macroeconomic approach to investing, Druckenmiller isn’t frightened to make exclusive and concentrated bets when he has substantial conviction.

At present his maximum conviction bet and biggest keeping in his portfolio is Coupang Inc., which is South Korea’s major on the web market. Together with Coupang, Druckenmiller positioned his fund to take benefit of this year’s AI increase, with major holdings in organizations like NVIDIA, Microsoft, and Alphabet.

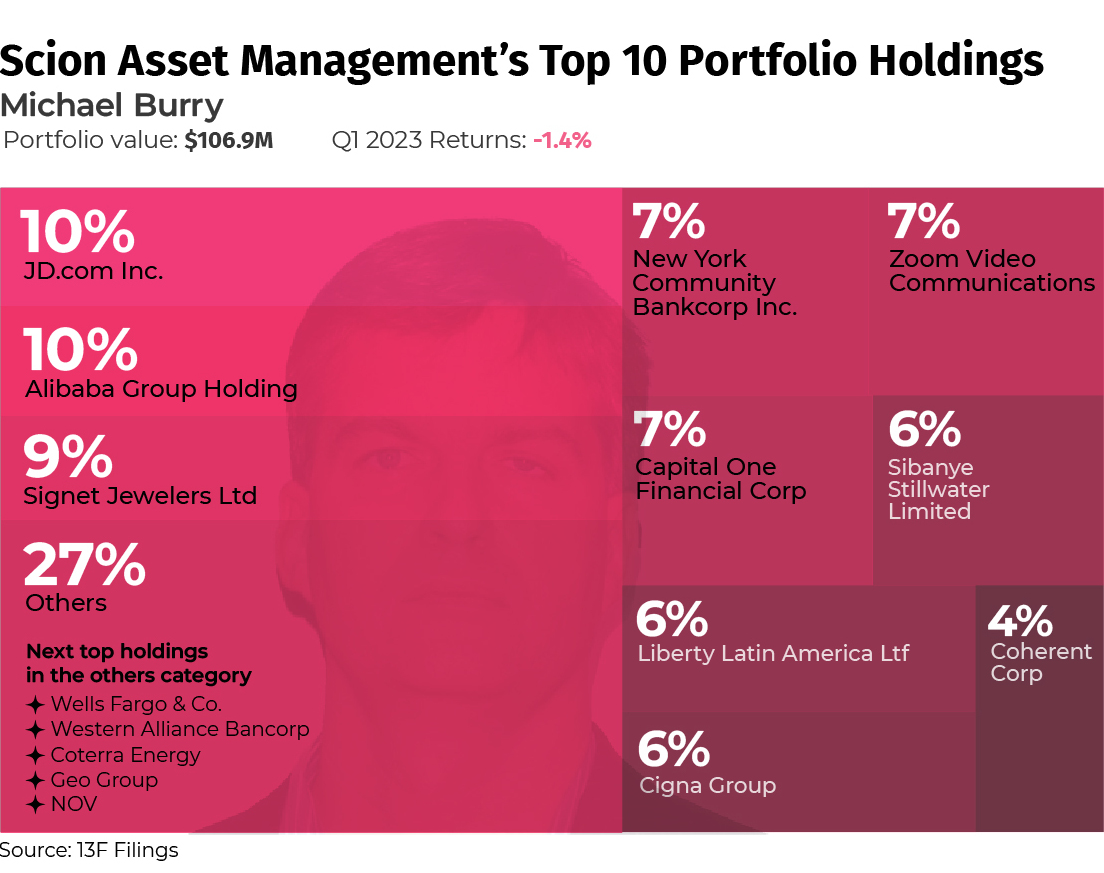

The smallest of all five resources we seemed at, Michael Burry’s Scion Asset Administration might be 1 of the greatest known for its job in predicting the 2008 monetary disaster early on.

The protagonist of the movie, The Significant Shorter, Michael Burry is greatest recognized for his intense short bets and in general worth investing method particularly in distressed assets.

Scion Asset Management’s portfolio displays this as a excellent part of its holdings at the finish of Q1 this calendar year were in different financial institution shares which had declined noticeably in the course of the thirty day period of March.

Burry’s major bets on the other hand are in Chinese ecommerce providers JD.com and Alibaba, indicating Burry’s perception in a customer driven economic reopening for China this yr.

|

Markets This Thirty day period by VC+

We hope you savored this excerpt by Niccolo Conte from Markets This Month, which hits VC+ subscribers’ inboxes each and every thirty day period. Get 25% off an once-a-year subscription to VC+ by clicking in this article. |