Table of Contents

There are a lot of investment sorts which you can start your quest of investing in. Shares, and bonds are some of the more typical ones that you would be able to put money into. The only thing difficult about them are the sub brackets that fall underneath these funding varieties. Whereas typically riskier than saving money in a financial institution, for people who are looking to make investments for the long term, historically talking you’ll develop your cash quite nicely. The three essential stuff that has acquired to be thought of while investing in a funding bond comprise the par worth, the maturity date, as well as the coupon price.

While there is a good likelihood that you’ll earn cash with a brief-time period funding, there may be additionally a chance that you will lose cash. Discover the market for available investment choices – The funding market is filled with alternatives, you can explore the market by making use of correct approach.

The higher the potential of earning by an investment car, the higher its danger and vice versa. Funding banks come in two sorts. Reasonable traders take chances with cash and bonds. From that viewpoint, earnings bonds are suitable only the place the investor can do without the cash for the time period of the bond.

Fastened fee bonds offer a high degree of stability to the investor, combined with the knowledge of how a lot shall be returned, on a month-to-month or annual foundation. Lively methods need common determination about what securities to invest in and the way much to speculate, as well as the timing of the sale of belongings and the reinvestment in new equities.

Funding Banking Varieties

Understanding Your probability tolerance and funding design power of character allow you to wish funds correctly. If you’re fascinated about shares, then you should be part of a great publication and useful resource program that provides the entire instruments and guides you want for investing in the very best shares. Median priced property has averaged growing at 2 – 4% p.a. higher than inflation, making it a really strong investment.

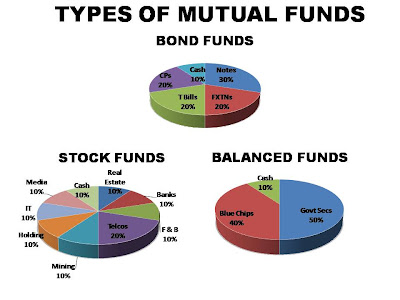

Unbiased investments serve different purposes and don’t compete with one another. In mutual funds, cash is being pooled collectively from completely different buyers with a view to pay knowledgeable fund supervisor and select the best securities for the group.

investment types pdf, investment types wikipedia, investment types ranked by risk

What’s the greatest kind of investment? Extra particularly, it tells you how your money is invested and in case your cash is protected from market fluctuations. Your whole investment portfolio must be spread amongst several types of investments with the intention to reduce your danger – in different phrases, do not put all of your eggs in one basket.

Best Types Of Investing Education

There are several various kinds of real property investments and it is very important understand what every sort of funding is and what the benefits and dangers concerned are. Final on the record are inventory investments, these are additionally long term financial savings. By the facet of the identical event, your economic targets energy of character along with determine what Design of investing you resolve. Due to these factors many of these traders are going to be trying into some properties which can be cheaper.

Low danger investments usually pay the bottom yields, but are far much less unstable than many different varieties of investments. They make investments privileged quantities of money in the sphere of riskier ventures in the hopes of attaining greater returns – both in excess of cash returns or else within the sphere of a succinct quantity of return.

investment types by risk, investment types of funds, investment types ppt, investment types in australia, investment types ranked by risk

There are lots of completely different strategies for property investing, which go well with completely different individuals depending on their present earnings or financial position.